GST Carousel Fraud was mentioned in the recent GST Conference 2016. However, the speaker did not say much on the GST Carousel Fraud.

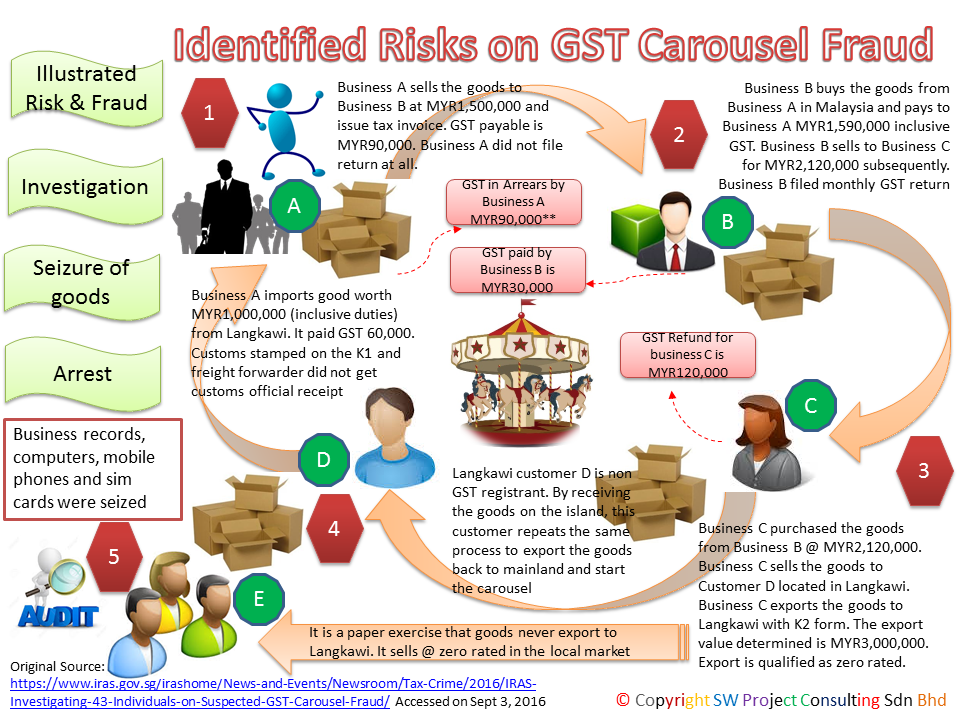

GST Carousel Fraud is a recent GST investigation case in Singapore on Aug 15 and 16, 2016. There were 43 people arrested. IRAS seized computers, SIM cards, mobile phones and business records in the opereation. IRAS viewed the GST Carousel Fraud as a serious event that leads to tax evasion with wilful intent.

We will not know the consequence if such case happened in Malaysia. However, we learn and prevent the risks that associated by the carousel fraud to trigger to your business. This is an illustrative case study created by GST System Changes for sharing purpose and this is not intended to relate to the overseas case law and intervene into any jurisdiction in Malaysia.

The mastermind of Business A creates a carousel to import goods from Langkawi and used freight forwarder to do customs clearance and transport the goods into mainland. It has K1 form and freight forwarder did not ask for customs official receipt on importation. Business A sells the goods to Business B in Malaysia. Business A issuing tax invoice for the supply. Business A is not filing its GST return before the due date and no payment made to RMCD.

Business B receives tax invoice from business A and sells to business C. Business B files GST Return and make GST payment to RMCD.

Business C is an export company and sells to Customer D. It exports the goods to Langkawi with K2 form. Business C is entitled for the input tax credit and it has no output tax payable.

Business D is not GST registrant. Once the goods reaches Langkawi, the same batch of goods can sell again and trigger the carousel, the contrived supply chain. It sells the goods back to Business A or other businesses to import the goods back to mainland again.

Alternatively, it is merely paper exercise but the presence of the goods remain within mainland, Malaysia. The goods subsequently sold to local market without any GST charged and collected. Business C claims GST input tax credit and no output tax payable.

What are the risks that Business A, B, C and D to take by participating in GST Carousel Fraud? How do you prevent such event happened to your business? You may want to express your opinion by writing to admin@swpc.com.my. Answer will send to you by email if you send your opinion.