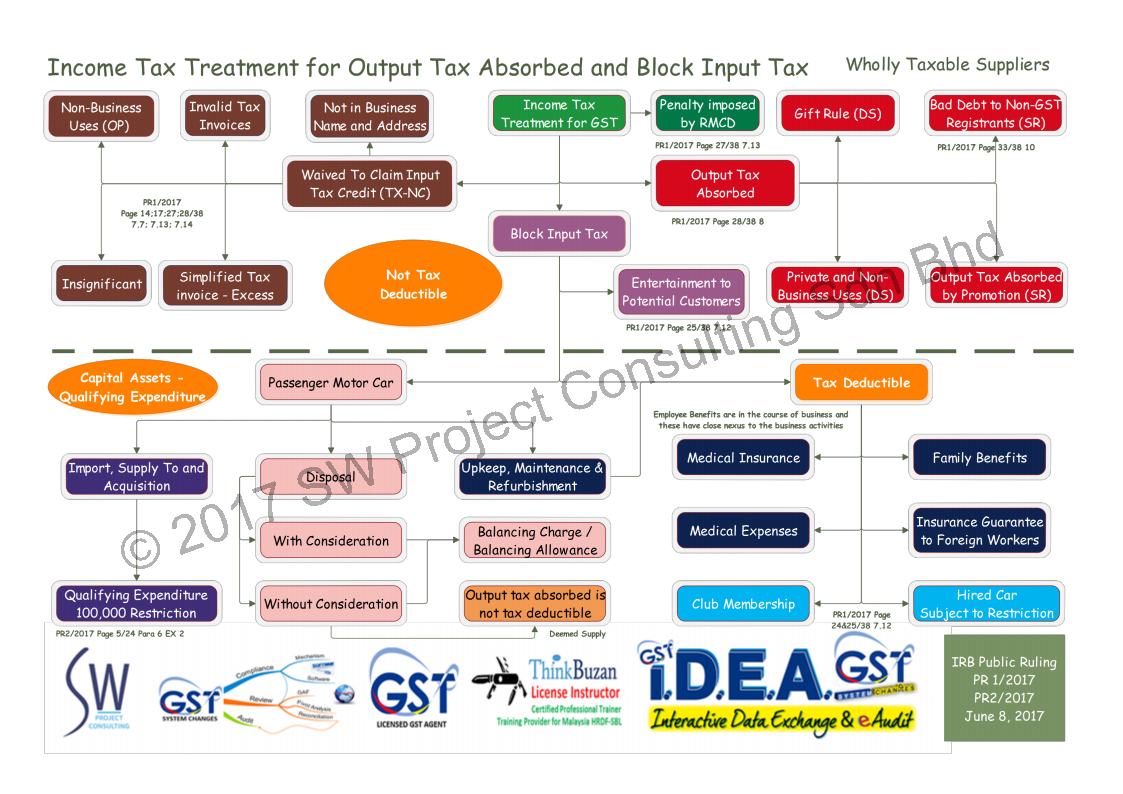

Inland Revenue Board (IRB) published two new public rulings on the GST treatment on June 8th, 2017. The public ruling has explained on the various income tax treatment for GST incurred by the GST registrants. The following topics covered in the public ruling:

- GST Input Tax Credit

- GST Block Input Tax Treatment for expenditure

- GST Block Input Tax Treatment for capital expenditure

- RMCD penalty imposed

- Partial Exempt Trader Adjustment on CGA

- Partial Exempt Trader treatment on input tax credit that cannot claim

- Partial Exempt Trader treatment on residual input tax credit that cannot claim

- Capital Goods Adjustment with Reinvestment Allowance

- Other topics

This article extracts the income tax treatment related to the following items in the visual map. This visual map only explains the scenario related to wholly taxable suppliers. The following items are summarized in visual map.

- Income tax treatment on output tax absorbed

- Income tax treatment on penalty imposed by RMCD

- Income tax treatment on input tax credit failed to claim or voluntarily waived the right to claim

- Income tax treatment on block input tax that is tax allowable

- Income tax treatment on block input tax that is not tax allowable

- Income tax treatment on block input tax that is capital expenditure, subject to qualifying expenditure

- Income tax treatment on the disposal of passenger motor car