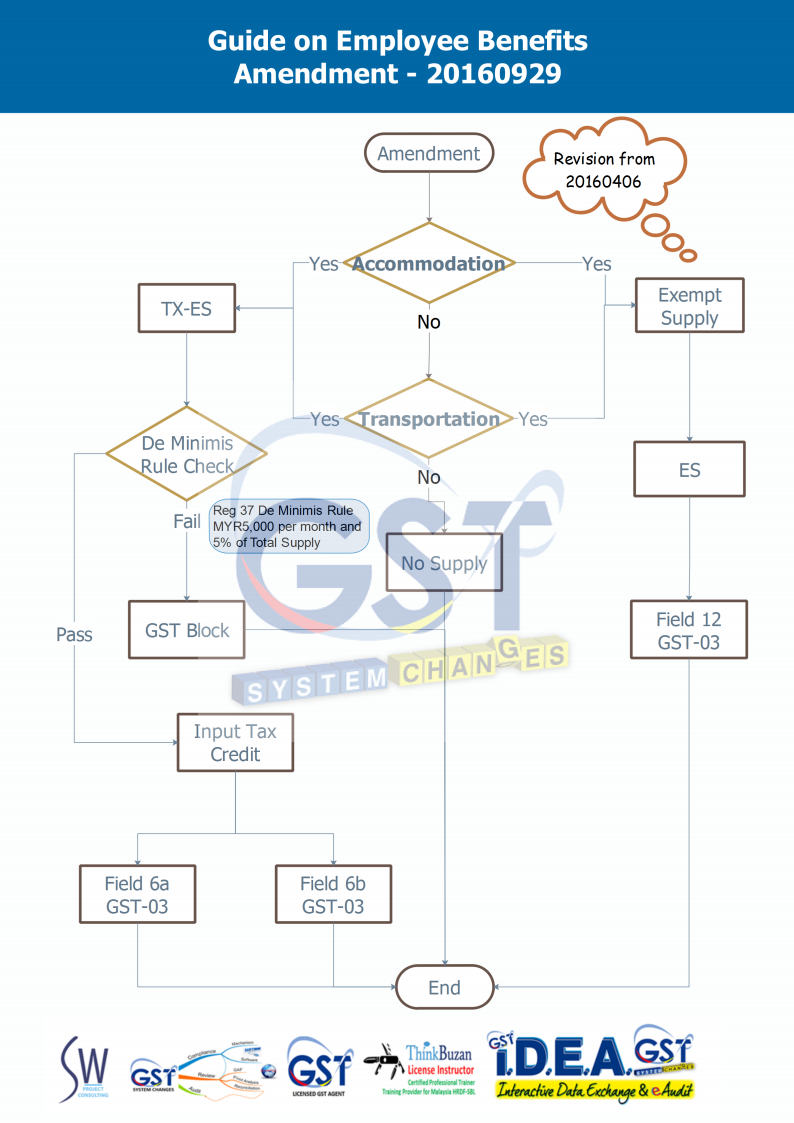

The recent amendment in Guide on Employee Benefits on 20160929 highlighted that all businesses which provide transportation and accommodation services shall treat as exempt supply. As such, input tax credit attributable to exempt supply cannot be claimed.

However, I further analyze that if the transportation and accommodation services together can pass De Minimis Rule, then all exempt input tax in that period shall be treated as attributable to taxable supplies. [Regulation 37, GST Regulations 2014].

As such, for the businesses which provide accommodation and transportation services shall assign TX-ES to its input tax credit related to the accommodation and transportation. Then the business shall test on De Minimis Rule to determine this input tax credit is available to claim.

Kindly refer to this flow chart for visual presentation.