E-Invoicing

This category is to group E-Invoicing articles together

- Details

- Written by: Administrator

- Category: E-Invoicing

- Hits: 1198

E-Invoicing Study: E-Invoicing Vendor Selection Consideration

As Malaysia is implementing E-Invoice in 2024, there are a number of service providers that wish to tender their E-Invoicing services to the businesses. In order to source for the correct type of vendor, businesses may consider the following criteria:

- Software and API (Application Programming Interface)

- This is a built-in API that is able to connect and sign-into IRBM MyInvois Portal for e-Invoice clearance. Software vendor and software developer will build the API accordidng to the guide issued by IRBM.

- Both local software and international software vendors including ERP vendors are capable to develop the API once the SDK is available and specification parameters are known.

- The vendor may provide the API to the businesses in the form of software upgrade or service pack to be installed in the current system in order to enjoy the benefits of e-Invoice clearance in IRBM Portal.

- It is very suitable for domestic businesses that owned a software, using cloud or software as a service. The main purpose of the business consideration is for tax compliance and e-Invoice clearance and validation.

- It is able to fit the domestic businesses that involve B2G, B2B and B2C that both seller and buyer will agree no exchange in e-invoices network.

- Domestic businesses that involve only in B2C will also find this model suitable for e-Invoice clearance. The consumer will accept the e-Invoice validated by IRBM from the seller.

- Other domestic businesses that do not aim for PEPPOL interoperability may choose this model, despite of the software may offer for PEPPOL features as well.

- E-Invoicing Advisor and Consultant

- These are the advisors that provide first learner experience on e-Invoicing to the businesses. Businesses may choose to engage the advisors if the business model is complex and needs guidance from the third party advisors.

- The advisor may provide E-Invoicing training, implementation, gap assessment, change management, business processes automation and other related e-Invoicing compliance to the businesses. The businesses may get updates and progress from time to time.

- The advisor can arrange in any form of online seminar, in-person workshop and in-house training to the public. They may advise on implementation strategies and offer process automation study to the businesses.

- It is able to fit the businesses who opt for tax compliance via e-Invoice clearance and PEPPOL interoperability implementation. The businesses shall engage these advisors to monitor the timeline and deliverables.

- Technology Solution Provider

- If the business possessed an in-house developed system, legacy system, non e-Invoicing compliant system or obsolete system, it is helpful to engage a technology solution provider to look for technical solution to fit in the e-Invoicing implementation. It is whether to continue with the existing solution or sourcing for new application.

- Businesses that use different systems for invoicing, billing, accounting and other front-end e-commerce solutions, the technology solution provider may be helpful to develop middleware for system integration between heterogeneity systems.

- Technology solution provider may develop an API or middleware for the businesses that use regional or grabal controlled ERP that local customization is not possible. Many MNC and shared service hub may consider third party technology service provider to manage technical request for local e-invoicing compliance and global IT resources.

- Technology solution provider may be able to assist in redesign and redevelop any non e-Invoicing compliant system or obsolete system upon request.

- MNC and shared service hubs that aim for e-Invoice clearance compliance and PEPPOL interoperability may consider technology solution provider to finetune and enhance the current system constraints.

- Access Point

- The main commercial model for access point is to provide e-Invoice clearance with tax authorities and exchange of e-Invoices within PEPPOL network.

- There are many international access point service providers that are ready to provide e-Invoicing tax clearance and distribution of e-Invoices via PEPPOL network. Local access points are currently being developed by MDEC and soon to be known the list of approved local and international access point operators.

- The distribution of e-Invoices aims to increase business efficiency via process automation.

- Businesses that involve in B2B and B2G that need to exchange e-Invoices via PEPPOL network shall consider access point for clearance compliance and distribution of e-Invoice with seamless interface.

- MNC, share service hub and businesses that deal with cross-border such as import and export may consider access point operator.

- Details

- Written by: Administrator

- Category: E-Invoicing

- Hits: 1471

E-Invoicing Study: Anticipated Components in Software Development Kit - System Specification

This article is trying to highlight the anticipated contents inside Software Development kit before the official document is scheduled to release in December 2023 or any time after the article publication.

The software development kit shall consider of the following sections:

- Digital Certificate and Signature

- IRBM announced in the guideline that digital signature is embedded into the e-invoice. Therefore, IRBM shall use Tax Identification Number to create the digital certificate for specific taxpayer as an authentication approach to validate the identity of the taxpayer. The SDK shall indicate a digital signature to be embedded in the e-invoice shall be based on one digital signature or shall use different digital signature that belongs to the same taxpayer for retailing e-invoice.

- Digital signature is mandatory to present in the e-invoice. The attached sample shows typical digital signature as Issuer's Digital Signature as mandatory field. However, the length of the digital signature is yet to be finalized.

- Quick Response Code QR Code

- QR Code shall include TIN and Seller's Name.

- The SDK shall indicate the development on QR Code whether it is based on Base64 string.

- The SDK shall indicate the contents of QR code in term of Tag, Length and Value (TLV)

- Provision for Data Dictionary - Helpful in XML schema

- The SDK shall provide complete lists of data dictionary as whether it is based on PEPPOL INTERNAITONAL (PINT) or Malaysia specific data field.

- It shall provide UBL XML schema sample to help in the software development and how to fill in from data catalogue published by IRBM.

- Provide sample value in each data field and whether validation will be done during validation stage.

- Provide indication whether the data field is mandatory or optional as not all e-invoices issued contain Sales Tax, Service Tax or Tourism Tax.

- Elaboration on File Storage Path

- IRBM provided the file storage in the e-invoice guideline. Therefore, the software development shall dedicate the folders to store the e-invoices generated before sending for validation and after validation.

- File Name Convention

- The SDK shall indicate the file name for generated e-invoices. The objective is to make sure that no e-invoices with the same file name are sent to IRBM for validation at the same time.

- Typical file name convention as below:

- TIN

- DATETIME

- E-Invoice Code / Number

- Example: C22218888888_20240801151308_INV12345.xml

- Details

- Written by: Administrator

- Category: E-Invoicing

- Hits: 1235

E-Invoicing Study: Anticipated Components in Software Development Kit Related to SST Malaysia.

As Malaysia is using Sales Tax and Service Tax as single tier indirect tax without input tax claim, the SDK shall consider issuing additional guideline while adopting Peppol or other standard in the development of E-Invoice. Majority of E-Invoice will not display tax value except SST and Tourism Tax.

The software development kit shall consider of the following sections:

- General Information, Scope, and Development Guidelines

- The SDK shall consist of general information about the purpose, scope, and target audience of this guide. It provides version control as to the changes in the SDK as well as providing a glossary of terms in the document.

- The next valuable piece of information is that the SDK must refer to the legislative documents that empower the development of E-Invoice.

- SDK shall highlight as to what standards to be used. For example, PEPPOL BIS, UBL and Malaysia specified standard related to Sales Tax and Service Tax (SST).

- It shall provide FAQ to address frequent questions to be asked by the audience and contact information for software developers to raise if any clarification is required.

- System Requirements

- The file name of the transmitted e-invoice must be unique so that no two businesses submit the e-invoices with the same file name.

- The file path is to store the cleared invoice and easy reference for the user to locate it

- Semantic definition for each data field stated in the guideline. Whether this is date, number, percentage, text fields etc. The SDK shall address to the maximum length of each data field that is used to keep bulk contents, for instance, invoice number reference for consolidated e-invoice on monthly basis.

- The data field released in the specific guideline shall map to the data dictionary, whether we follow PEPPOL or any other standards.

- QR Code specification can help the software developer to create QR code and is easy for verification purpose.

- Business Processes

- The SDK shall provide complete lists of common business processes that are defined in e-invoice development. For example, a business process requires whether an e-invoice has a valid invoice reference number. Calculation of the price, quantity and discount are correctly at item line as well as sub-total and grand total.

- Since Malaysia is using sales tax and service tax (SST), the SDK shall publish a set of business processes related to SST transactions in Malaysia. As e-invoice may consist of sales tax or service tax exemption, the business rule needs to check whether the exemption certificate is available before the tax value field is calculated as zero instead of tax value.

- The rounding mechanism is also important for quantity, price and total. The SDK shall give an example of how the rounding works.

- Item line total aggregate must be tally with sub-total and grand total.

- Business Validation Rules

- The common business validation rules shall check the semantic data types as date and time, percentage, numeric and text data fields. The business validation rule shall cross-check the validity of NRIC, TIN, BRN and SST ID while it shall not check if it is foreign passport number.

- Other common business validation rules from Peppol and EN 16931 shall also apply to e-invoices. For example, an e-invoice must consist of an invoice reference number.

- The SDK shall publish a set of Malaysia-specified business validation rules such as Sales Tax and Service Tax calculation and sales tax exemption certificate validation.

- Disaster Recovery and Error Handling

- The SDK shall suggest and recommend disaster recovery plans related to blackouts, Internet Unavailability in rural areas, and system failure handling procedures.

- The SDK shall publish the error-handling procedure and reporting related to tax authority portal (MYINVOIS Portal) unavailability.

- Details

- Written by: Administrator

- Category: E-Invoicing

- Hits: 1852

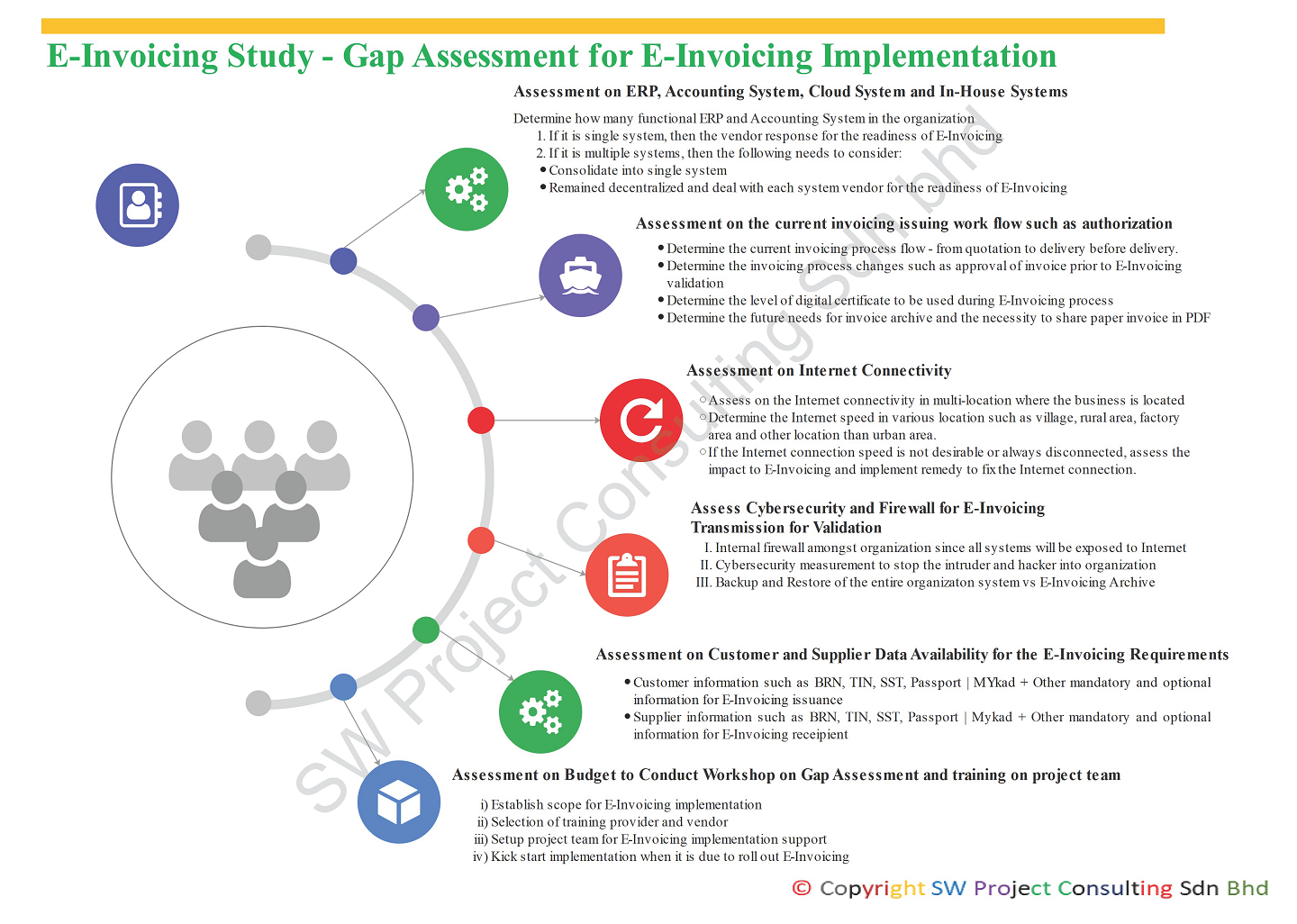

E-Invoicing Study - Gap Assessment for E-Invoicing Implementation

Before E-Invoicing is going to implement in Malaysia in 2024, the organization needs to perform a gap assessment to the current invoicing workflow to determine any procedure changes to accommodate with the E-Invoicing implementation initiative.

Let's look at six areas to address the gap between current process and E-Invoicing process:

- Assessment on ERP, Accounting, Cloud and In-house system: The number of invoicing systems used in the organization. This is to assess the impact of the future direction on whether it shall consolidate into single system for better E-Invoicing operation or remain decentralized to assess the readiness for E-Invoicing integration from different vendors.

- Assessment of the current invoice authorization workflow: This is to assess the current invoice issuing authority so that proper digital signature can be assigned to the right personnel. This is applicable as to the organization using multi-systems and with multi-level authorization to issue and approval invoice. Once the cleared invoice is returned, the organization will consider whether it is still necessary to send PDF invoice to the recipient and archiving options for invoices.

- Assessment of the Internet connection: This is to assess whether invoice generation process needs to be centralized or still decentralized as not all areas will get a strong internet connection. The E-Invoicing validation may post a challenge if the connection with the tax authorization is lagging, slow or disconnected.

- Another assessment in the cybersecurity and firewall: This is to assess the organization firewall can stop cyber-attack from the hackers as to E-Invoices are sent for validation and returned cleared E-invoices to the organization.

- Assessment of customers and vendors data availability: As E-Invoicing will require the master data from the customer such BRN, TIN, SST, MyKad and Passport number. This assessment is to classify data availability of the customers to fit into the organization invoicing generation system. Similarly, the same will apply to the vendors.

- Assessment on budget to conduct workshop and preparation for E-Invoicing implementation: Vendor selection to setup project team and staff training to kick-start E-invoicing implementation.

- Details

- Written by: Administrator

- Category: E-Invoicing

- Hits: 1702

E-Invoicing Study - Gap Assessment for E-Invoicing Implementation Part 2

Businesses in Malaysia may need to investigate more detail gap assessment after IRBM announced and published E-Invoicing revised guideline version 2.0 and specific guideline version 1.0 on September 29, 2023.

Let's look at additional six areas to address the gap between current process and E-Invoicing process in Part 2:

- Assessment on invoice format revision. The specific guide showed a sample invoice in PDF that consists of more information than the current acceptable invoices with prescribed information. Additional information to display in the new invoice format may include TIN, NRIC, passport, SST ID and other data fields prescribed in the specific guide. The new invoice format must re-design to find places to accommodate new data elements on the invoice. A human readable PDF invoice still requires sharing with recipient or buyer who cannot generate E-Invoice or consumer. Sales Tax and Service Tax and tourism registrants need to ensure that the calculation of tax amount and input exemption details for those qualified with SST exemption.

- Assessment on the requirement of Self-Billing E-Invoice and Accounting Treatment: There are several focus areas that may subject to Self-Billing E-Invoice mechanism. For example, imported service tax will be paid directly to RMCD and at the same time, IRBM needs to issue Self-Billing E-Invoice as part of E-Invoicing mechanism. As such, businesses may need to determine when to trigger the accounting treatment, following the tax point of imported service tax or following the time to raise Self-Billing E-Invoice. Can the ERP or accounting system be issuing E-Invoice without accounting treatment? In addition, If the employee is acting on behalf of the employer to acquire goods and services but does not bring back qualified E-Invoice due to incorrect information stated on E-Invoice, shall the accounting treatment to be triggered as non-tax allowable expenses? Sometimes it is too tedious to ask the supplier to cancel an E-Invoice with a credit note and re-issue a new E-Invoice with all the correct information.

- Assessment of transactions with buyers (B2B) based on industries: This is to assess whether buyers involved are B2B or B2C or both. Additional data elements such as Import | Export | Incoterm needs to be present in the Annexure of E-Invoice. B2B E-Invoicing is two-way verification and sharing of E-Invoice. Businesses may need to consider options for the buyers who are yet to participate in E-Invoicing Framework.

- Assessment of transactions with buyers (B2C) based on industries: This is to assess whether buyers involved are B2B or B2C or both. Businesses may consider specific classification for the goods sold to the consumer as stated in the data catalogue published by IRBM on September 29, 2023. Petrol stations may develop a mobile app for the patron to refill the petrol to issue E-Invoice. Some industries may consolidate all sales to consumer with an E-Invoice while other industries are prohibited to combine into a consolidated E-Invoice. There may not need recipient to receive E-Invoice validation notification.

- Assessment of Legal Documents, Contracts and Employment Contracts: As E-Invoicing will impact the invoicing processes, businesses need to assess whether any updates on legal terms are inside their contracts. Their contracts may need the buyer and the seller to disclose their TIN, SST ID, BRN and Tourism Tax ID whenever it is applicable. Sales Contracts and Purchase Contracts may state E-Invoicing Provisions and revised terms of acceptance. As for the employer that acts on behalf of the employer may need to provide company information such as TIN, BRN, SST ID or Tourism Tax ID to the employer to acquire goods or services. The current structure of the contract of service needs to be reviewed.

- Assessment of a Change Management Strategy for Adopting E-Invoicing Effectively: Once the gap assessment is completed, all findings shall be summarized to support changes from paper-based invoicing process to E-Invoicing process. A subject matter expert shall monitor the entire change process once all information such as SDK and legislation are in order. The subject matter expert shall continue to finetune and improve the implementation of E-Invoice based on the latest amendment and changes. It shall ensure clear communication to all stakeholders such as IT, project team, staff, external technology service provider, creditors, debtors and public. Change management must make sure people, process and technology are in order.

- Details

- Written by: Administrator

- Category: E-Invoicing

- Hits: 1094

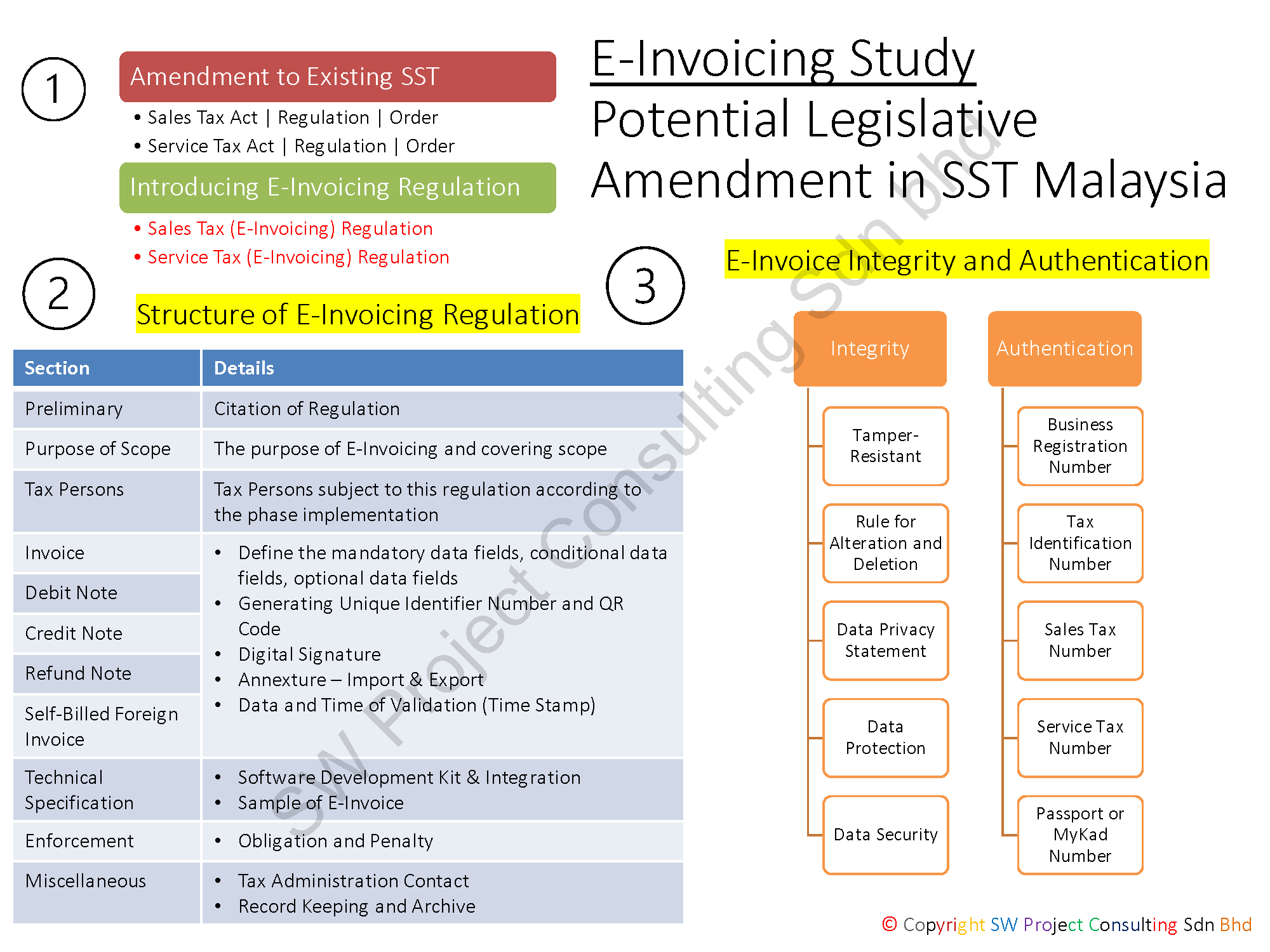

The following slide is an illustration for e-invoicing study - potential legislative amendment in SST Malaysia.

The indirect tax mechanism in Malaysia is a single-stage sales and service tax (SST). It comprises of two independent mechanisms, sales tax, and service tax. respectively.

The indirect tax mechanism in Malaysia is a single-stage sales and service tax (SST). It comprises of two independent mechanisms, sales tax, and service tax. respectively.

To implement electronic invoice or E-Invoice to cover the invoice generation process in SST registrants, the following act needs to be amended and accommodated for whatever impacts to the operation of SST.

- Sales Tax Act 2018

- Service Tax Act 2018

- Sales Tax Regulation (amendment and new legislative document)

- Service Tax Regulation (amendment and new legislative document)

- Sales Tax Order (amendment and new legislative document)

- Service Tax Order (amendment and new legislative document)

If the government introduces new legislative document for E-Invoicing project, the following could be new legislative documents:

- Sales Tax (E-Invoicing) Regulation

- Service Tax (E-Invoicing) Regulation

There are a number of amendments to be made in the E-Invoicing Regulation such as the following:

- Mention about the definition, purpose, and scope of E-Invoicing and how the E-Invoicing is operating in Malaysia

- Tax Persons or SST registrants' involvement in the phase implementation of E-Invoicing project

- Requirements for the business documents such as invoice, credit note, debit note, refund note and self-billed foreign invoice. Amendment details could be some of the details mentioned in the above slide.

- Technical specification - Release of software development kit and integration model. It would be great to provide a sample of XML E-Invoice and whether allow software developer to share PDF/A-3 (with XML embedded) compliant with the buyer.

- Enforcement will highlight on those responsibilities and obligation of the tax administration and SST registrants

- Miscellaneous will highlight on the contact of tax administration division and the method for record keeping and archive mechanism.

E-Invoicing implementation project shall highlight in term of integrity and authentication of E-Invoice as below:

- The integrity of an E-Invoice:

- E-Invoice shall be tamper-resistant for any unlawful changes

- E-Invoice procedure rules on alteration and deletion before validation

- Data privacy statement, Data Protection and Data Security in MyInvois Portal

- The authenticity of an E-Invoice:

- Business Registration Number (BRN)

- Tax Identification Number (TIN)

- Sales Tax Registration Number

- Service Tax Registration Number

- Passport or MyKad Number

Disclaimer:

The above illustration slide is for E-Invoicing study purposes. The views expressed in this article are the author's own views. You must not rely on the information on the slide as an alternative to solicit advice from another appropriately qualified professional.

Subcategories

E-Invoice Workshop Article Count: 4

e-Invoice Workshop, Training and Online Seminar