Please take note that you shall update of your GST detail if it is different from the registration via GST portal.

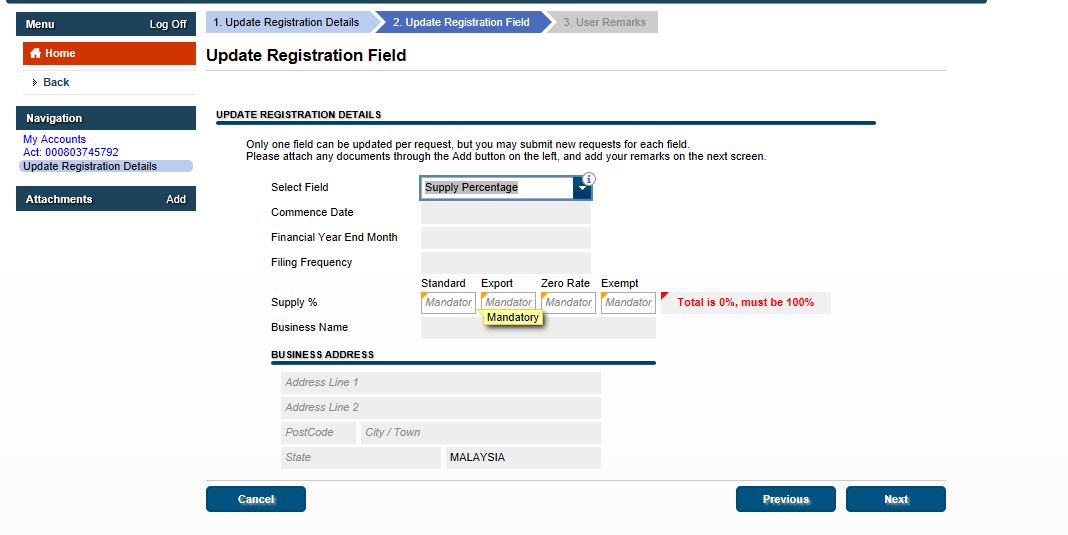

This image shows "Update Registration Details". Once you log in, you are able to move to the next screen to choose the options to update. Click to view enlarge image:

This image shows Update Registration Field. There are six types of updates:

- Business Address

- Business Name

- Commence Date

- Filing Frequency

- Financial Year End

- Supply Percentage

The important is to update filing frequency if you are struggling between Monthly and Quarterly submission.

You need to update supply percentage if it is not in line with your current GST operation. For example, state as wholly taxable supplier but involves zero rated supply and relief supply.