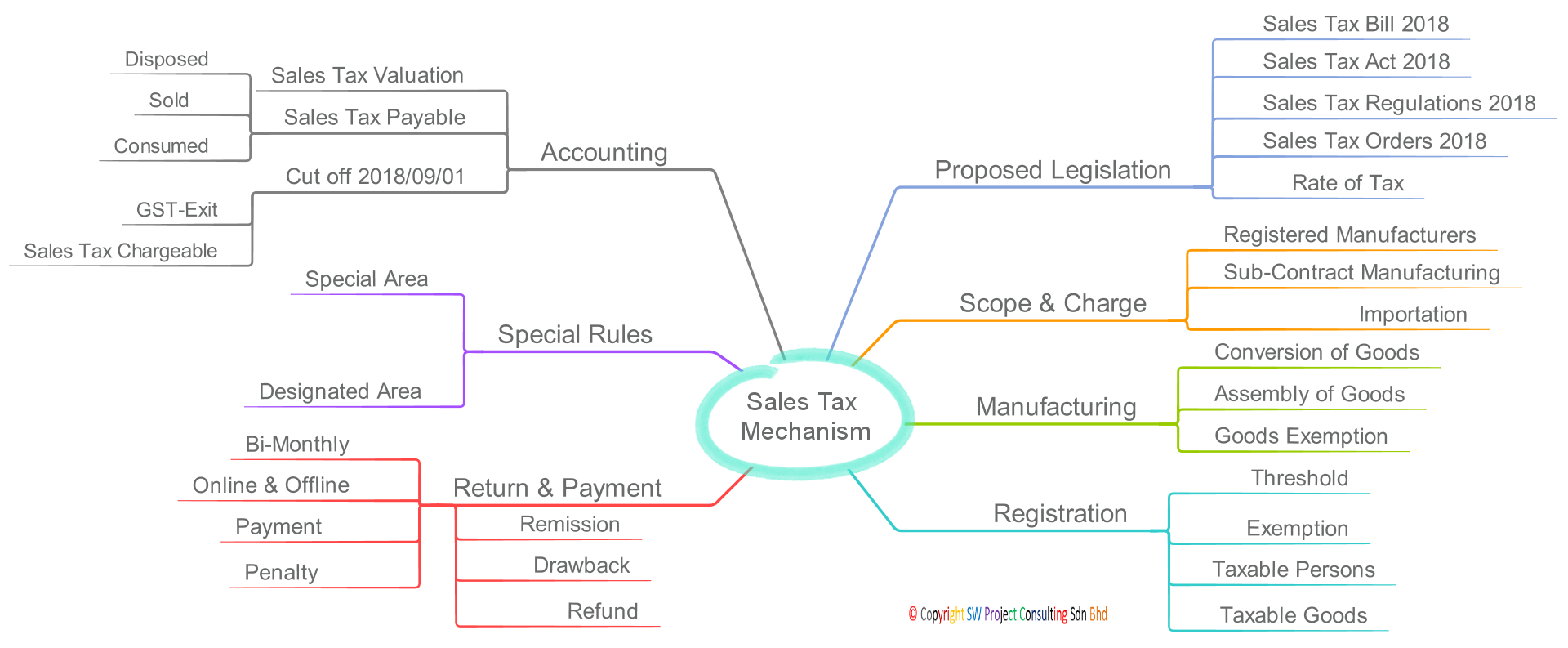

RMCD announced SST - Sales Tax and Service Tax Framework on July 19, 2018. The framework has been modified from the previous Acts in 1970s. This article shows the high level key areas in the SST - Sales Tax and Service Tax Framework.

You may subject to Sales Tax if:

- You are a manufacturer who sells, disposes or uses goods

- You are an importer of goods

- You are currently a GST registrant and your MSIC shows that you are involved in manufacturing and assembling of goods

You may subject to Service Tax if: